Big Data Security Market Share and Strategic Developments

Comprehensive examination reveals complex dynamics shaping the big data security industry landscape systematically. Big Data Security Market Analysis provides stakeholders with insights enabling informed strategic decision-making processes. The Big Data Security Market size is projected to grow USD 53.87 Billion by 2035, exhibiting a CAGR of 14.81% during the forecast period 2025-2035. Porter's Five Forces analysis reveals attractive industry dynamics with strong growth potential observed continuously. Supplier power remains moderate as security technologies source from multiple established vendors globally available. Buyer power varies based on organization size with large enterprises commanding significant negotiating leverage. Threat of substitutes remains limited as traditional security inadequately addresses big data protection requirements. New entrant threats exist though established vendors maintain advantages through technology portfolios and expertise.

SWOT analysis illuminates strategic factors affecting big data security market participants and positioning. Strengths include specialized protection addressing unique distributed architecture and scale requirements effectively. Integration with big data platforms enables seamless security without performance degradation impacting analytics. Automation reduces manual security effort enabling protection of massive data volumes efficiently managed. Weaknesses include complexity challenges requiring specialized expertise for effective implementation and operation. Performance overhead concerns may limit adoption of comprehensive encryption in latency-sensitive applications. Opportunities include expanding regulatory requirements driving mandatory security investments across jurisdictions globally. Threats include rapidly evolving attack techniques potentially outpacing security capability development temporarily observed.

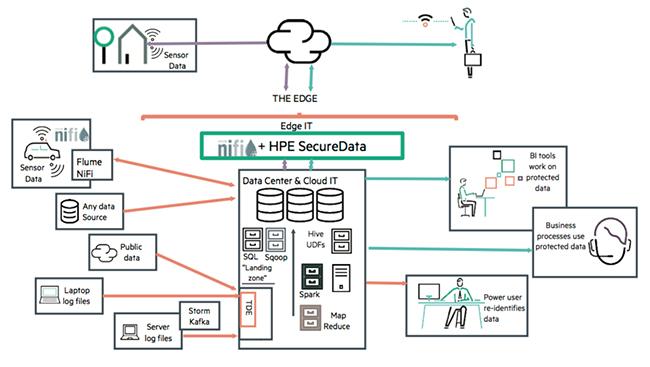

Value chain analysis examines how big data security solutions progress from development through customer protection. Research and development creates security technologies addressing unique big data protection challenges encountered. Product development builds commercial solutions integrating security capabilities for customer environments deployed. Distribution delivers security solutions through direct sales, partners, and cloud marketplaces accessible. Implementation deploys and configures security within customer big data environments for operational protection. Operations maintains security effectiveness through monitoring, updates, and threat response activities continuously. Support and optimization ensures security solutions address evolving requirements and threats detected ongoing.

Investment analysis tracks capital flows into big data security market from various sources monitored. Venture capital investments support innovative startups developing next-generation big data security technologies emerging. Private equity enables established security companies to expand capabilities through acquisitions completed successfully. Corporate investments from security vendors fund product development and market expansion activities substantially. Enterprise investments represent budget allocations for big data security implementations and operations funded. Government investments support critical infrastructure big data protection and cybersecurity research initiatives. Understanding investment patterns reveals market momentum and development directions anticipated by stakeholders.

Top Trending Reports -

South Korea Holographic Communication Market

- Personal Growth and Empowerment

- Career & Professional Development

- Business & Finance

- Health & Wellness

- Relationships & Community

- Lifestyle & Creativity

- Technology & Digital Life

- Inspiration & Spotlight

- Events & Programs

- Mindset & Motivation Tools